Defining Fee Descriptions and Tax Rates

Fees are charges that are unrelated to overdue fines. Examples of fees include patron registration charges or the price of a pair of headphones. Tax rates are for libraries that charge a Goods and Services Tax (GST). Using the Fee Descriptions policy table, you can:

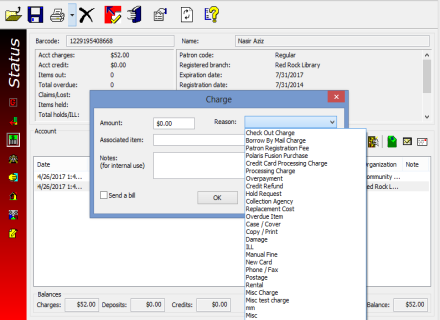

- Enter fee descriptions so library staff can select them from a predefined list.

- Set a default amount for each fee description.

- Set a tax rate for each fee description.

Entries in this policy table appear as selections on workform views and dialog boxes where you handle patron charges, such as the Reason list from which you can select a fee reason when adding a charge to a patron's account. Entries also appear in Leap.

You must go to the Administration Explorer to view the Fee Descriptions policy table. All organizations in a Polaris installation must agree on the fee descriptions. You can add and change entries in the Fee Descriptions policy table, but you cannot delete them.

You can create fee descriptions at the system and library levels, but the entries are assigned to the system. You must be working at the system level to configure tax rates and default fee amounts for fee descriptions. Tax rates and default fee amounts do not appear in the library or branch level Fee Descriptions policy tables.

At the branch level, you can set which reasons are available to branch staff and determine the order of the branch-level selections. Some libraries prefer alphabetical order; others prefer to put the most commonly used selections first. You can also edit the description display text, however the system applies these changes system-wide.

Note:

These System Administration permissions are required to modify this table: Access administration: Allow, Access tables: Allow, Modify fee descriptions table: Allow.

See also: