Add a fee description and tax rate entry

Fees are charges that are unrelated to overdue fines. Examples of fees include patron registration charges or the price of a pair of headphones. Tax rates are for libraries that charge a Goods and Services Tax (GST). For overview information, see Defining Fee Descriptions and Tax Rates.

To add a fee description to the Fee Descriptions policy table:

Note:

Check existing descriptions before you add a new one. You cannot delete duplicate descriptions.

-

In the Administration Explorer, open the Policy Tables folder for the organization, and select Fee Descriptions. The Fee Descriptions table is displayed in the details view.

Note:

In the Fee Descriptions table, ID numbers preceded by a minus sign are supplied by the system and used in system processes.

-

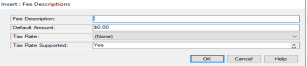

Click

to display the Insert Fee Descriptions dialog box.

to display the Insert Fee Descriptions dialog box.

-

Enter text describing the type of fee in the Fee Description box.

-

Enter a Default Amount.

Default amount starts as $0.00.

-

(Optional) Select a Tax Rate.

-

If this fee description includes a tax rate, select Yes. Otherwise, select No.

-

Click OK.

The Fee Descriptions policy table appears with the new fee description name. The status bar indicates that the modification is pending.

-

Select File > Save to save your changes.

The status bar indicates that the record is saved.

Related Information

- The system immediately applies any changes to an existing fee description or tax rate to all records using the original fee.

- A changed tax rate might not appear in Leap unless you perform an IISRESET, clear the browser's cache, and refresh the page.

-

For accounting purposes, do not update fee descriptions that have been used for charges on patron accounts. If you make changes to fee descriptions, the system applies those changes to past charges and new charges.

- Set branch-level display - See Set fee descriptions for branch-level display.

- Replacement fees - You can set a default replacement fee amount and a processing fee amount for items the library cannot recover. See Setting Replacement Fee Defaults.